October 2024

Commercial payments, transactional FX, treasury solutions and financial institution (FI clients) advisory services are set to be transformed with the introduction of dbX, Deutsche Bank’s new umbrella suite of correspondent banking tools

Launched on 14 October 2024, these provide FI clients access to new and enhanced functionalities that deliver full principal payment solutions to end beneficiaries – thus building on the work already underway with utilities such industry initiatives such as SEPA One-leg-Out and Swift Go. The suite leverages the banks extensive global network and also opens up connectivity and payment infrastructures across the world.

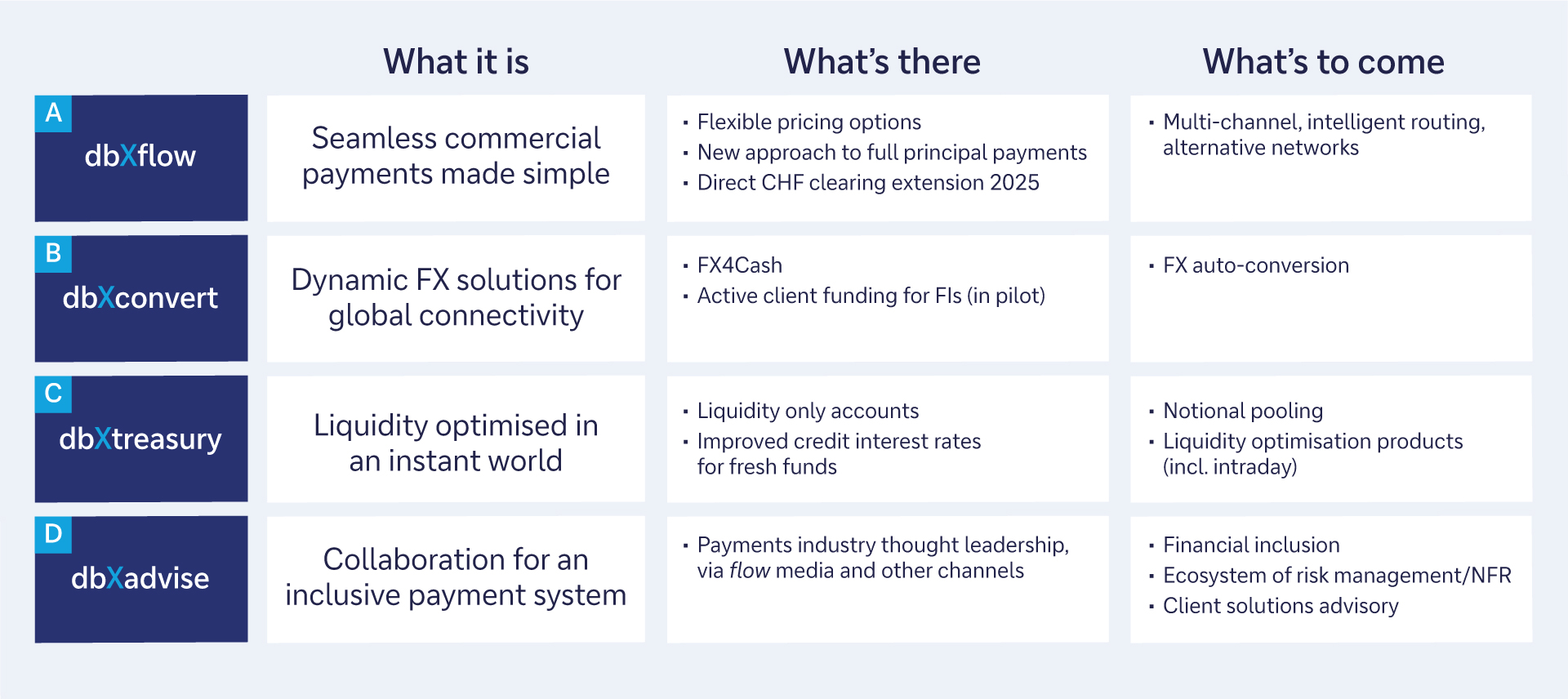

Figure 1: Components of dbX

The first wave of the launch focuses on enhancing Deutsche Bank’s commercial payments, transactional FX, treasury solutions and advisory offerings – made available through four core solutions:

- dbXflow. This offers a complete range of cross-border commercial payment services – available for EUR, USD and GBP. New elements have been incorporated, including a low value full-principal payment proposition for EUR payments with significantly enhanced bespoke pricing capabilities. With industry initiatives, many of which fall under the umbrella of the G20 Roadmap, taking time to gain traction in the market, Deutsche Bank aims to offer immediate benefits to its FI clients rather than wait for mass market adoption.

- dbXconvert. An enhanced range of transactional FX services, with new functionalities available for FI clients through the existing FX4Cash platform, its global cross-currency platform with 130+ currencies, new functionalities are being added to the platform. The FX4Cash engine will be upgraded to allow FI clients to fund Deutsche Bank in their own currency (e.g., DKK) without the need for a Deutsche Bank account in this currency. Clients can utilise the engine to convert into another currency (e.g., ZAR). In a second step, the bank will introduce its auto-convert solution to automatically convert commercial cross-border payments to the local currency of the beneficiary for specific corridors.

- dbXtreasury. This expands Deutsche Bank’s current liquidity offering, focusing on intraday solutions for managing FI treasury needs in an instant world. New functionalities in the form of Intraday Liquidity Optimisation with the use of advanced data and analytics will be introduced that can help clients reduce liquidity usage and improve payments functioning.

- dbXadvise. This combines individual advisory capabilities with extensive but flexible information, thought leadership (such as relevant articles in flow) and data tools as part of Deutsche Bank’s strategy to operate in a more efficient, safer and inclusive correspondent banking ecosystem. Advisory services range from supporting clients with the complexities of conducting business in challenging markets, through to offering self-service tools, data provision on liquidity positions and flexible API reporting capabilities.

“The launch highlights our commitment to empowering FI clients to succeed in the global marketplace”

Commenting on the launch of dbX, Patricia Sullivan, Deutsche Bank’s Global Head of Institutional Cash Management, said, “The launch highlights our commitment to empowering FI clients to succeed in the global marketplace – and reaffirms our commitment to meeting both the current and future needs of our clients.”