October 2023

Deutsche Bank publishes initial Transition Plan to reach net zero in 2050

Deutsche Bank has outlined plans to decarbonise its business with clients, its value chain and its own operations by 2050, including net zero targets for three additional carbon-intensive sectors: coal mining, cement and shipping

Deutsche Bank’s newly released Transition Plan consolidates the bank’s definitions, methodologies, targets and achievements on its path to net zero by 2050 in a single publication. This plan focuses on three dimensions of decarbonisation: the bank’s own operations (Scope 1 and 2); supply chain (Scope 3, category 1-14); and financing provided to clients (Scope 3, category 15 – Greenhouse Gas Protocol). As a new element the plan introduces net zero targets for three additional carbon-intensive sectors: coal mining, cement and shipping.

“We are committed to playing our part in fighting climate change, and we want to document transparently where we stand on our path to net zero,” said Christian Sewing, Chief Executive Officer, Deutsche Bank. “We are convinced that it is imperative for a global bank headquartered in Europe to position itself as a sustainability leader if it is to have lasting success in serving its clients. Decoupling economic growth from CO2 emissions and the extensive use of natural resources will be decisive as our planet’s ecosystem comes close to tipping points.”

“Our ambition is to partner with our clients on their decarbonisation journey and to shape the real economy transition to net zero," adds Lavinia Bauerochse, Global Head of ESG at Deutsche Bank Corporate Bank. “Net zero requires considerable investment in the transformation and decarbonisation of business models. The financial industry has a key role to play as a partner to the real economy in mobilising and directing the necessary capital.”

Derived from this strategic ambition are three financing strategies for Deutsche Bank corporate clients:

- Green/sustainable strategies: financing and assisting companies that enable emission reductions through their green products and services;

- Transition strategies: support companies worldwide which have embarked on the journey to decarbonize their business. To do so, we encourage clients in carbon-intensive sectors to meet key requirements, such as actionable transition plans;

- Phase-out strategies: steadily phase out business with not-to-abate industries, such as thermal coal, and with clients unwilling to align to our transition pathway.

Tackling carbon-intensive sectors

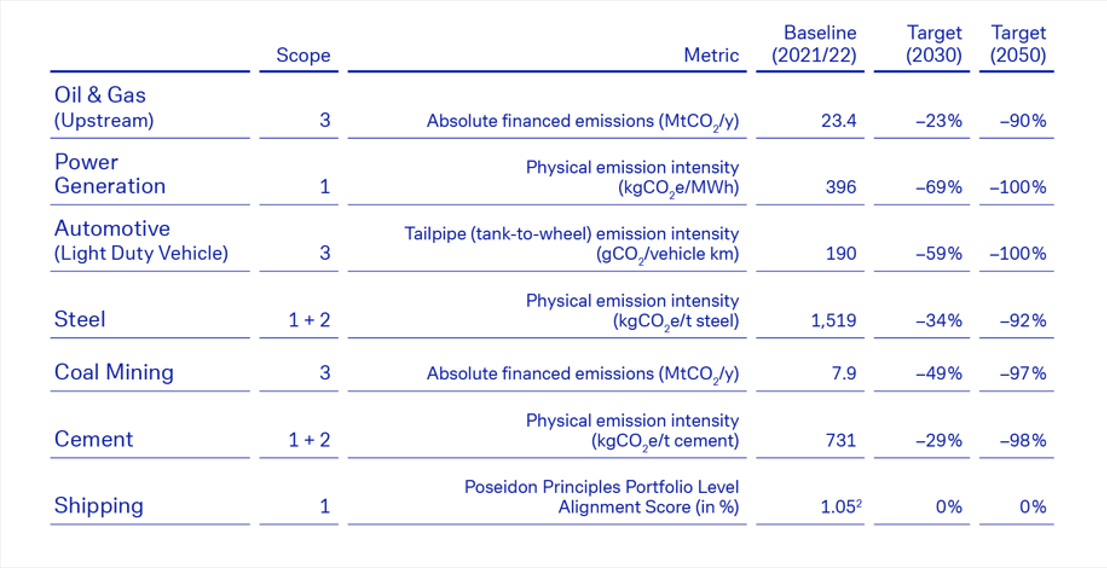

In October 2022, Deutsche Bank announced its first phase of net zero aligned targets for 2030 and 2050 in four carbon-intensive sectors: oil and gas; power generation; automotive; and steel. The initial Transition Plan now outlines the second phase of the bank’s programme for net zero pathways in carbon-intensive industry sectors financed through the bank’s €107bn corporate loan book, which accounted for financed emissions (Scope 3, category 15) of 30.5m tonnes of CO2e/y in 2022. The additional targets for these three sectors are:

- Coal Mining: 49% reduction in Scope 3 financed emissions by 2030, and 97% reduction by 2050

- Cement: 29% reduction in Scope 1 and 2 physical emission intensity by 2030 and 98% reduction by 2050

- Shipping: Scope 1 scoring of 0% achieved by 2030 and 2050 based on the Poseidon Principles Portfolio Level Alignment Score

Thus, Deutsche Bank has now defined sectoral decarbonisation targets for 2030 and 2050 for the seven most carbon-intensive sectors which account for 55 % of our total financed emissions as of year-end 2022 (see Figure 1). Implementation of the Transition Plan focuses on working at the level of individual clients and transactions and on asset-level.

Figure 1: Sector-specific metrics for Deutsche Bank’s net zero journey1

Jörg Eigendorf, Chief Sustainability Officer, Deutsche Bank said: “Our Transition Plan sets out what clients and the public can expect from us as we scope out our role in decarbonising the economy. As the economy progresses toward net zero, regulations, reporting standards, and the role of the banking industry will evolve. This will allow us to continuously refine our own Transition Plan.”

Building on strong foundations

The Plan is underscored by tangible near-term targets for sustainable finance volumes, as published in our Sustainability Deep Dive in March 2023:

- €500bn cumulative sustainable financing and investment volumes 2020-2025 (excl. DWS)2

- €5bn accumulated sustainability-linked working capital loans by 2025

- €3bn sustainable finance for emerging markets from 2023-2025

Underlying these targets are three main frameworks, which ensure generally accepted international standards and principles are being followed:

- Sustainable Finance Framework: Methodology for classifying transactions and financial offering as sustainable

- Green Financing Framework: Methodology for issuance of use-of-proceeds-based green financing instruments

- Environmental and Social Policy Framework: Approach to managing environmental and social risks in line with Global Reputational Risk Framework (thermal coal policy, updated May 2023, as a key element of decarbonization approach)

Looking to the future – as industry standards, data availability, reporting, technology, and client behaviour continues to evolve – Deutsche Bank aims to broaden the scope of its own transition to net zero and the bank’s contribution to society’s progress toward that goal. This includes, for example, expanding business activities to support enablers of nature-based solutions and biodiversity, as well as factoring in the social implications of the economy’s transition toward net zero – especially in developing countries.

Deutsche Bank’s Transition Plan is available for download on the bank’s website

Sources

1 The climate alignment score for shipping is as of year-end 2021 (please note that the Poseidon Principles have their own baseline year of 2008)

2 Sustainable financing and investment activities as defined in Deutsche Bank’s Sustainable Finance Framework and related documents, which are published on our website