February 2024

Deutsche Bank ups its clutch of Euromoney Trade Finance 2024 Survey No 1 successes to 17 in a year of inflection for trade

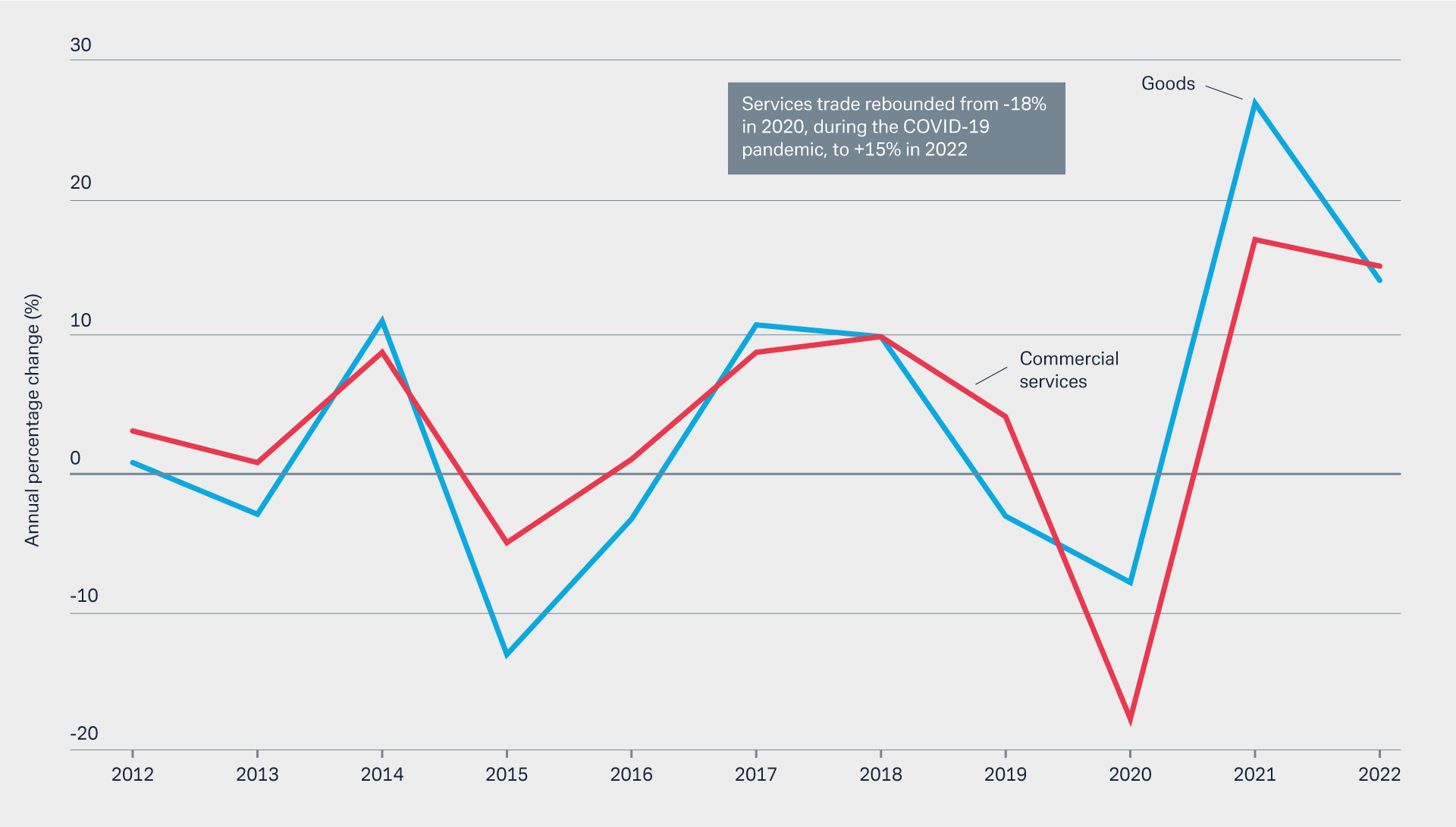

World trade as we once knew it is changing. While it is still “a force for economic recovery and resilience” as described by WTO Secretary General Ngozi Okonjo-Iweala in 2023,1 merchandise trade growth has slowed while services trade growth has risen.

Although the full 2023 picture is not yet complete, this does appear to be the direction of travel as the shock response to the pandemic continues working through the system and additional geopolitical shocks compound one another. Furthermore, technological advancements as we move through the Fourth Industrial Revolution (4IR) towards the fifth iteration (5IR) in journeys of digitalisation and personalisation respectively have changed the nature of global supply and demand. “Computer networks – from streaming games to remote consulting services – are an emerging source of growth, accounting for 54% of global services exports in 2022, and 12% of total global trade in goods and services,” noted Okonjo-Iweala last year.

Figure 1: World trade in goods and commercial services, 2012-22 (Annual percentage change)

Source: World Trade Statistical Review 2023

New global trade order

Other characteristics of a very different trade landscape include:

- Deglobalisation. At the January 2024 BAFT European Bank to Bank Forum in Frankfurt, panelists observed how globalisation has retreated, with nearshoring established at the margins along with “friendshoring” where supply chains are shaped according to the partner country’s “ideological alignment”.

- Continued geopolitical volatility. Two years into the Russia/Ukraine conflict there are no signs of an end with supplies of essential commodities from both territories such as food, energy and fertilisers to poorer countries remaining disrupted.2 The impact on global energy prices was a main trigger of the 2023 inflation spikes. Added to that the tensions in the Middle East, particularly around container shipping routes, which are injecting delays and higher costs into trade. The International Energy Agency noted in its February 2024 Oil Market Report, “As a number of tanker owners diverted ships away from the Red Sea to around the Cape of Good Hope, observed onshore [oil] stocks declined by nearly 40 million barrels.”3

- Infrastructure investment. Emerging economies such as India and some African countries are investing heavily in infrastructure in the form of transportation (roads, airports, railways) and digital connectivity (mobile networks etc). This has attracted foreign direct investment and lending, as governments partner with global banks via export finance structures.

- Decarbonisation. The outcome of COP28 discussions in Dubai last December underlined the need for sustained commitment (and investment) to convert decarbonisation pledges from warm words into reality. The development of the electric vehicle (EV) market, and the dynamics of the semiconductor market – together with renewable energy projects – are just some examples of the kind of trade that didn’t exist a decade ago.

- Higher interest rates. As central banks grapple with inflation (again this was succinctly explained at the BAFT European Bank to Bank Forum in Frankfurt), uncertainty prevailed around the cost of capital with the Federal Reserve having hiked rates from almost zero in early 2022 to 5.25-5.50% last summer. The Fed has since stated that it needs greater confidence of inflation “moving sustainably towards 2%” before it can ease rates. Similar firm stances are being taken by other major economy central banks.4

Impact on trade finance

“Financing demand across the stack – from short-term working capital to long-term capex investment – is down on account of higher interest rates,” noted Atul Jain, Co-Head of Trade Finance and Lending at Deutsche Bank. But, he added, “We see that partly offset with increased demand from global corporates for documentary trade and wider risk management and hedging solutions, a function of the continued volatility and uncertainty through which they must navigate.” Jain further highlighted the rising role of the Middle East – particularly visible in recent commitments to fund various AI and chip infrastructure investments, as well as in the setup of the IMEC (India-Middle East-Europe Economic Corridor).

The continued role of governments themselves on both the demand and supply side of financing has, added Oliver Resovac, Co-Head of Trade Finance and Lending at Deutsche Bank, “continued to take form across the infrastructure thread – from renewables to EVs to semiconductors to defence to social housing.”

“We would like to take this opportunity to thank our clients for their continued trust in our capabilities”

Euromoney Trade Finance Survey – the results

Given this backdrop of volatility and uncertainty, the Euromoney Trade Finance 2024 Survey results where Deutsche Bank won 17 No 1 placings globally (10 Market Leader, seven Best Service) – three more than in 2023 – were especially reassuring.

The 2024 awards voting received around 13,470 respondents – an increase of 25% on 2023.

Determined by quantitative rather than qualitative and subjective feedback, these awards are an important barometer of how a bank is meeting client needs.

“These awards mean a huge amount to us at Deutsche Bank,” said Jain and Resovac. “We would like to take this opportunity to thank our clients for their continued trust in our capabilities to best advise them during these turbulent times, as well as for their active participation in the survey,” they added.

Category: Market leader

Here we were awarded 10 Market Leader positions between the Best Overall and Best Domestic categories:

- Western Europe (Overall and Best Domestic)

- Germany (Overall and Best Domestic)

- Malaysia (Overall)

- The Netherlands (Overall)

- Pakistan (Overall)

- South Korea (Overall)

- Spain (Overall)

- Thailand (Overall)

Category: Best Service provider

- Germany (Best Domestic)

- Japan (Overall)

- Middle East (Overall)

- Philippines (Overall)

- Saudi Arabia (Overall)

- Thailand (Overall)

- United Arab Emirates (Overall)

Atul Jain

Co-Head of Trade Finance and Lending, Deutsche Bank

Oliver Resovac

Co-Head of Trade Finance and Lending at Deutsche Bank