Moving goods and services across borders and within supply chains is highly complex and exposes counterparties to a wide range of risks – most particularly non-payment. Trade finance delivers fast, efficient, reliable and comprehensive solutions for every stage of a client's trade value chain to support their foreign and domestic trade activities

Managing trade risks

When carrying out cross-border business, importers and exporters are exposed to specific risks, such as exchange and currency risks, non-payment, damage to goods in transit and fraud, etc. Let our experts advise you on the best way of mitigating this

Show content of Trade risks to consider

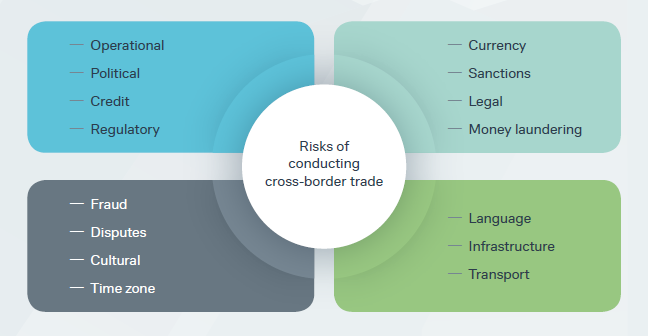

First assess your risk using the Figure 1 below as a guide. What jurisdiction and regulatory regime are you working in? Could there be a foreign exchange risk? Is there any political risk?

Figure 1: Trade risks to consider

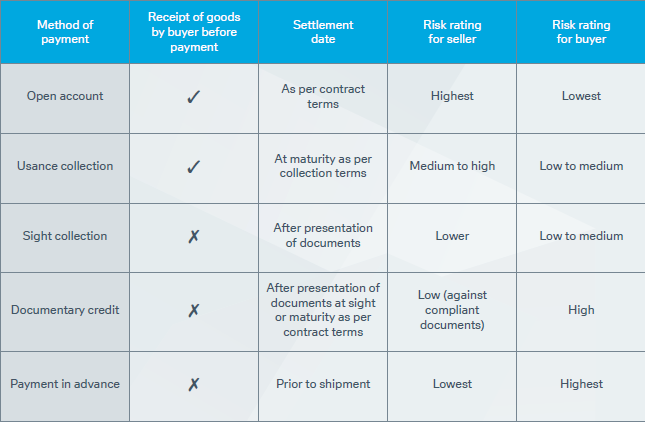

Then take a look at your own risk appetite when it comes to your transaction. Open account – with no form of trade finance is risky for the seller and has a very low risk to the buyer (apart from supply security). But payment in advance is of significant risk to the buyer and a low risk to the seller. Can trade finance help manage this?

Euromoney Trade Finance Survey 2025

Deutsche Bank secures 25 No 1 trade finance rankings in Euromoney’s new market data-based awards for 2025, as global trade growth reaches new high World’s Best Trade Finance Bank for Large Corporates

Your Global Hausbank

What challenges in trade are you facing?

From arranging a letter of credit to unlocking export credit agency support we can help. Please select one or more options below by clicking in the boxes

Letters of credit, documentary collections and guarantees

Securing supply chains and paying suppliers

Accessing export credit agency support

Financing commodities and natural resources

Business loans

Financing sustainability

Download Existing client

and looking for forms on guarantees and letter of credits?

Download DownloadTF Message Hub TF Message Hub

A new SWIFT message gateway we offer to our financial institutions clients communicating with us by SWIFT

TF Message Hub MoreGlobal solutions for your specific needs

Our range of solutions seamlessly covers classic trade flow products and services such as letters of credit and guarantees; all aspects of export finance, commodities finance, as well as securing supply chains with intuitive supply chain finance solutions. Our team advise on counterparty and country risk, local regulatory regimes and work with other financial institutions to share trade finance risk when required

Explore more

Latest news News and press releases

Latest news about what’s happening globally and locally

FLOW

More Explore more on trade finance @flow

Exclusive insights and reference tools from the world of corporate and institutional financial services. flow, through articles, special reports and broadcast media is where goods, capital and ideas connect

More More